Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies on the global currency market. I don't have personal opinions or beliefs, but I can provide you with an objective perspective on Forex trading.

Forex trading has become increasingly popular in recent years,. as it provides individuals and institutions with opportunities to speculate on currency price movements and potentially profit from them.

The Forex market is the largest and most liquid financial market in the world, with trillions of dollars traded daily. This high liquidity allows for easy execution of trades, and it means that traders can enter and exit positions quickly without significant price slippage.

Forex trading is accessible to a wide range of participants, including individuals, banks, corporations, and institutional investors. The market operates 24 hours a day, five days a week, allowing traders from different time zones to participate at their convenience

The Forex market is known for its volatility, which can present both opportunities and risks. Volatility provides traders with the potential for profit, as currency prices can experience significant fluctuations in relatively short periods.it also increases the risk

Forex trading often involves the use of leverage, which allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it also magnifies losses. Therefore, it's important for traders to understand and manage their risk

Our mission in forex trading is to achieve consistent profitability by making informed and disciplined trading decisions. We aim to develop a deep understanding of the foreign exchange market, employ effective trading strategies, manage risk appropriately, and continuously improve our skills and knowledge. Our mission also includes promoting ethical trading practices, maintaining high levels of professionalism, and fostering a positive trading community. Ultimately,our goal is to generate sustainable returns while minimizing losses and preserving capital.

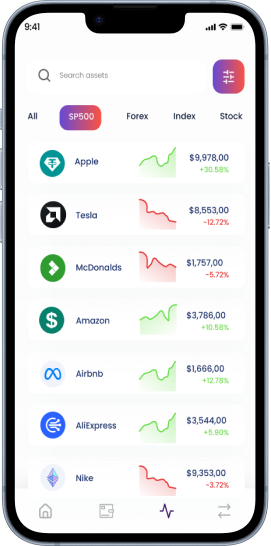

The main difference between the two is that Forex is limited to currencies while Contracts for Difference (CFDs) cover a broader range of asset classes. This includes Shares, Indices, Commodities and Cryptocurrencies.

This depends on a number of factors including the currency you wish to trade, any time constraints and trading strategies. It is important to note that the forex market is most active when major trading sessions overlap.

MetaTrader 4 is the world's most popular trading platform. Specifically designed for forex trading, it has an array of features and tools that help provide an exceptional trading experience. Those who are looking for a more elaborate platform can consider MetaTrader 5.

Algorithmic trading is trading based on an algorithm or set of computer programs that include a specific set of rules to execute market orders such as stop-loss orders. Expert Advisors (EAs) and copy trading software such as AutoTrade are examples of algorithmic trading.

Learn all you can about the market. Understand how forex trading can benefit you and ascertain what time you can dedicate to it. Learn how to decipher market fundamentals and how to study charts.

A regulated or licensed broker will provide a certain level of protection and provide you the necessary tools to trade efficiently. Open an Blufx LLC demo account and access our educational materials and you can practice strategies in live market pricing, without risking capital.

Decide on your risk/reward profile. How much of your capital can you afford to lose while trading? Based on that, choose your leverage. When you are a beginner, it is a good idea to start low.